Cyber Insurance: What Every Business Owner Needs to Know

In today’s digital age, an ever-increasing threat of cyberattacks is faced by businesses. As technology evolves, the tactics of cybercriminals are also evolving. Consequently, companies must prepare themselves for the potential financial losses and reputational damages that cyber incidents can cause. At this point, cyber insurance becomes essential.

What is Cyber Insurance?

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is a specialized insurance product designed to protect businesses and organizations from financial losses resulting from cyber incidents. These incidents may include data breaches, hacking attacks, ransomware, and other forms of cybercrime.

Importance of Cyber Insurance for Businesses

In today’s interconnected world, no business is immune to cyber threats. Whether you’re a small startup or a large corporation, the consequences of a cyber attack can be severe. From financial losses to reputational damage, the impact can be long-lasting and difficult to recover from.

Having cyber insurance is crucial for businesses of all sizes. It acts as a safety net, providing financial protection and support when you need it the most. With the right cyber insurance policy in place, you can have peace of mind knowing that you have the necessary resources to mitigate the impact of a cyber attack and get your business back on track.

Types of Cyber Insurance Coverage

Cyber insurance policies can vary in terms of the coverage they offer. It’s important to understand the different types of coverage available to ensure that you choose the right policy for your business.

- First-party coverage: This type of coverage protects your business directly. It typically includes coverage for expenses related to breach response, such as forensic investigations, legal fees, and public relations efforts. It may also cover financial losses resulting from business interruption and extortion.

- Third-party coverage: This type of coverage protects your business in the event that a third party, such as a customer or vendor, sues you for a cyber incident. It can cover legal fees, settlements, and judgments.

- Network security liability coverage: This type of coverage protects your business if a cyber attack or data breach leads to the theft or compromise of sensitive customer information. It can cover costs associated with notifying affected parties, providing credit monitoring services, and defending against lawsuits.

- Regulatory coverage: This type of coverage helps businesses comply with various data protection regulations. It can cover fines and penalties imposed by regulatory bodies in the event of a data breach.

Understanding the different types of cyber insurance coverage is essential to ensure that you choose a policy that aligns with your business needs and potential risks.

Understanding Cyber Liability Insurance

One important aspect of cyber insurance is cyber liability insurance. This type of coverage specifically focuses on protecting businesses from legal claims arising from a cyber incident. Cyber liability insurance can cover legal fees, settlements, and judgments associated with lawsuits related to data breaches, privacy violations, and other cyber-related incidents.

Cyber liability insurance is particularly important for businesses that handle sensitive customer data or operate in industries where data breaches can have significant legal and financial consequences. It provides a layer of protection that can help businesses navigate the complex legal landscape that often follows a cyber incident.

Cyber Insurance for Small Businesses

Contrary to popular belief, cyber attacks are not limited to large corporations. In fact, small businesses are often targeted by cybercriminals due to their relatively weaker security measures. As a small business owner, it’s important to understand the risks you face and the potential impact of a cyber attack on your business.

Cyber insurance for small businesses can provide the necessary financial protection to help you recover from a cyber incident. It can cover expenses such as breach response, business interruption, and legal fees. Additionally, cyber insurance can also provide coverage for the costs associated with regulatory fines and penalties, which can be particularly devastating for small businesses.

Benefits of Having Cyber Insurance

Having cyber insurance offers numerous benefits for businesses. Here are a few key advantages:

- Financial protection: Cyber insurance provides financial support to cover the costs associated with a cyber attack, such as breach response, legal fees, and regulatory fines. This can help businesses avoid significant financial losses and maintain their operations.

- Reputation management: A cyber attack can have a lasting impact on a business’s reputation. Cyber insurance can help cover the costs of public relations efforts and other reputation management strategies to mitigate the damage and rebuild trust with customers.

- Peace of mind: Knowing that you have cyber insurance in place can provide peace of mind. It allows you to focus on running your business, knowing that you have a safety net in case of a cyber incident.

- Compliance with regulations: Many industries have specific data protection regulations that businesses must comply with. Cyber insurance can help cover the costs associated with regulatory fines and penalties, ensuring that your business remains compliant.

How to Choose the Right Cyber Insurance Policy

Selecting the right cyber insurance policy for your business can be a complex task. Here are some factors to consider when evaluating your options:

- Risk assessment: Assess the specific cyber risks your business faces. Consider factors such as the type of data you handle, your industry, and your security measures. This will help you determine the coverage limits and types of coverage you need.

- Policy terms and conditions: Carefully review the terms and conditions of each policy you are considering. Pay attention to coverage limits, exclusions, deductibles, and waiting periods. Make sure the policy aligns with your business needs and potential risks.

- Claims process: Evaluate the claims process of each insurance provider. Look for a provider that offers a streamlined and efficient claims process, ensuring that you can get the support you need in a timely manner.

- Reputation and financial stability: Research the reputation and financial stability of the insurance provider. Look for a provider with a track record of excellent customer service and a strong financial standing.

Taking the time to evaluate your options and choose the right cyber insurance policy is essential to ensure that you have the necessary coverage to protect your business.

Cyber Insurance Claims Process

In the unfortunate event of a cyber attack or data breach, it’s important to understand the claims process for your cyber insurance policy. While the claims process may vary depending on the insurance provider, here are some general steps involved:

- Notify the insurance provider: As soon as you become aware of a cyber incident, notify your insurance provider. Be prepared to provide details about the incident, including the date and time of the attack, the nature of the breach, and any immediate actions you have taken to mitigate the impact.

- Document the damages: Gather evidence and document the damages resulting from the cyber incident. This can include financial losses, breach response expenses, and any other costs incurred as a result of the attack.

- Submit the claim: Complete the necessary claim forms provided by your insurance provider. Be thorough and provide all required documentation to support your claim.

- Claims assessment: The insurance provider will assess your claim and determine the coverage and amount payable under your policy. This process may involve investigations and consultations with relevant experts.

- Claim settlement: If your claim is approved, the insurance provider will provide the agreed-upon payment. The timing of the settlement may vary depending on the complexity of the claim and the insurance provider’s internal processes.

It’s important to familiarize yourself with the claims process outlined in your cyber insurance policy to ensure a smooth and efficient claims experience.

Common Misconceptions About Cyber Insurance

There are several common misconceptions about cyber insurance that can prevent businesses from obtaining the necessary coverage. Let’s debunk some of these misconceptions:

- “My business is too small to need cyber insurance”: Cyber attacks can affect businesses of all sizes. In fact, small businesses are often targeted due to their relatively weaker security measures. Cyber insurance is essential for businesses of all sizes to protect against potential financial losses and reputational damage.

- “My general liability insurance covers cyber incidents”: General liability insurance policies typically do not provide adequate coverage for cyber incidents. Cyber insurance is specifically designed to address the unique risks associated with cyber attacks and data breaches.

- “Cyber insurance is too expensive”: The cost of cyber insurance can vary depending on factors such as the size of your business, the industry you operate in, and the coverage limits you choose. While the cost may vary, the financial protection and support provided by cyber insurance far outweigh the potential costs of a cyber incident.

- “Cyber insurance is a one-size-fits-all solution”: Cyber insurance policies can be tailored to meet the specific needs and risks of your business. It’s important to work with an insurance provider who understands your industry and can customize a policy that aligns with your unique requirements.

Understanding these misconceptions can help businesses make informed decisions about obtaining the necessary cyber insurance coverage.

Cyber Insurance for Different Industries

Cyber insurance is not limited to specific industries. Businesses across various sectors can benefit from having cyber insurance in place. Here are a few industries that can particularly benefit from cyber insurance:

- Healthcare: The healthcare industry handles a vast amount of sensitive patient data. Cyber insurance can provide financial protection in the event of a data breach or ransomware attack, helping healthcare organizations maintain their operations and protect patient privacy.

- Financial services: Financial institutions are prime targets for cyber attacks due to the valuable financial information they possess. Cyber insurance can help banks, credit unions, and other financial institutions mitigate the financial and reputational impact of a cyber incident.

- Retail: The retail industry faces the risk of data breaches and point-of-sale attacks. Cyber insurance can provide coverage for the costs associated with customer notification, credit monitoring services, and potential lawsuits.

- Technology: Technology companies are at the forefront of innovation, but they also face unique cyber risks. Cyber insurance can help protect technology companies from financial losses resulting from cyber attacks and intellectual property theft.

Regardless of the industry you operate in, it’s important to assess the cyber risks specific to your business and obtain the necessary cyber insurance coverage.

Cybersecurity Measures to Complement Cyber Insurance

While cyber insurance provides valuable financial protection, it’s important to implement cybersecurity measures to prevent and mitigate the impact of cyber attacks. Here are some key measures to consider:

- Employee training: Educate your employees about best practices for cybersecurity, such as identifying phishing emails, using strong passwords, and recognizing potential security threats.

- Regular software updates and patches: Keep your software systems up to date with the latest security patches and updates. This helps address known vulnerabilities and minimize the risk of a successful cyber attack.

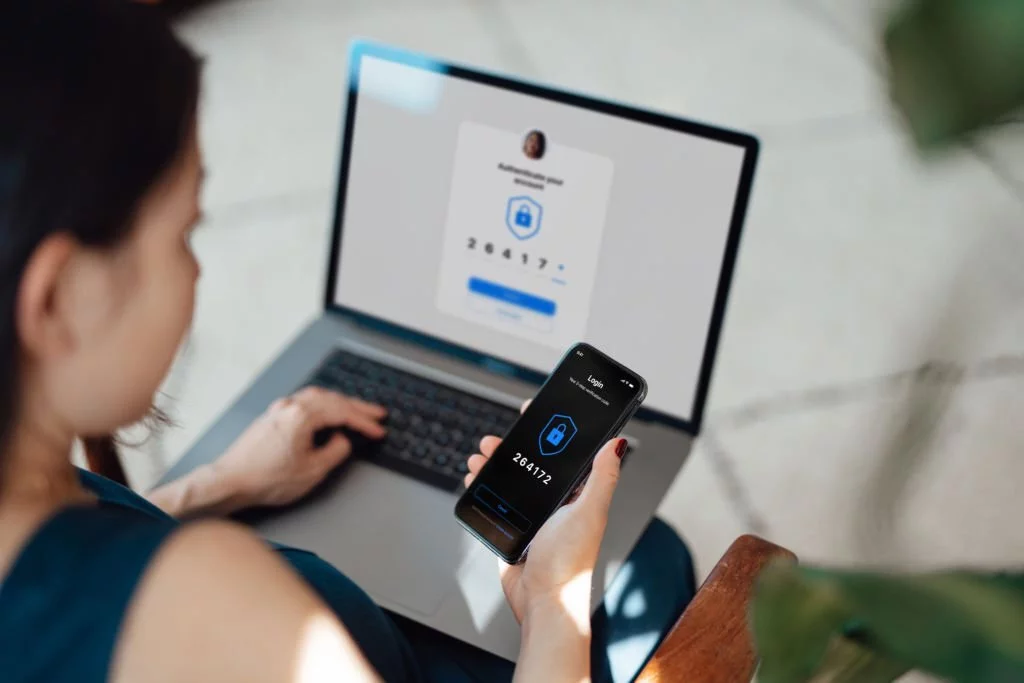

- Strong access controls: Implement strong access controls, such as multi-factor authentication and user privileges, to restrict access to sensitive data and systems.

- Data encryption: Encrypt sensitive data to protect it from unauthorized access. This ensures that even if data is compromised, it remains unreadable to unauthorized individuals.

- Regular backups: Regularly backup your data and systems to minimize the impact of a ransomware attack or data loss. Test your backups periodically to ensure their integrity and accessibility.

By implementing these cybersecurity measures, you can strengthen your overall security posture and complement the financial protection provided by cyber insurance.

Conclusion

In today’s digital landscape, cyber threats are a constant concern for businesses. Cyber insurance is an essential tool to protect your business from the financial and reputational impact of a cyber attack or data breach. Understanding the different types of cyber insurance coverage, the claims process, and the factors to consider when choosing a policy is crucial for every business owner.

By carefully assessing your cyber risks, obtaining the right cyber insurance coverage, and implementing robust cybersecurity measures, you can safeguard your business against potential threats and ensure its long-term success.